E-commerce in Latin America: A rapidly expanding market

The e-commerce market in Latin America is experiencing unprecedented growth, positioning itself as one of the most dynamic and promising regions globally.

Driven by increasing access to the internet and mobile devices, this market has seen a significant rise in connectivity, reaching a 70% penetration rate in 2020, according to studies by Latitud.

The COVID-19 pandemic not only brought challenges but also triggered an e-commerce boom, making Latin America the global leader in growth with a rate of 37% in 2020.

With more than 300 million digital buyers, according to Statista data, this figure is expected to grow by 44% by 2029, highlighting the region’s vast potential.

E-commerce in Latin America reached an estimated $272 billion in sales in 2023, and the B2C market is projected to surpass $7.5 trillion by 2030, according to a study by Payments Cards & Mobile.

This landscape presents a unique opportunity for merchants looking to expand their reach and offer products and services in emerging markets.

The growth of cross-border e-commerce in Latin America

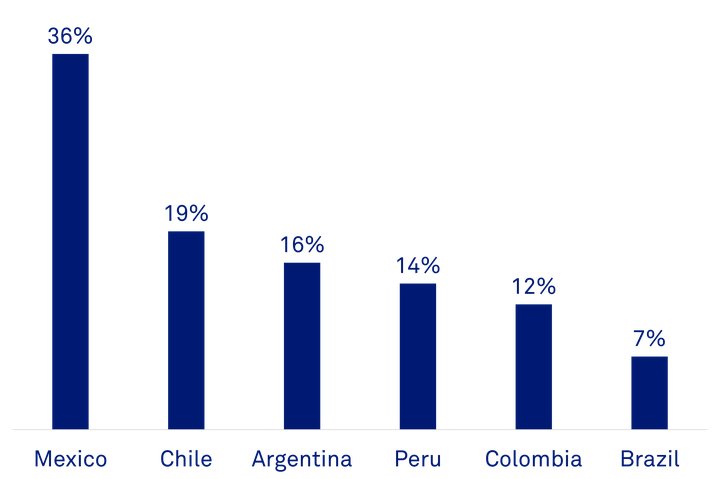

Cross-border e-commerce | Source: Statista

Cross-border e-commerce is experiencing significant growth in Latin America, driven by rising demand for international products and the limited availability of foreign brands in the region.

Another Statista study found that in 2022, over one-third of online purchases in Mexico came from international shops, while in Chile and Argentina, these accounted for 19% and 16% of total sales, respectively.

In Brazil, although cross-border commerce only made up 7% of total sales, the growth potential is immense.

Retailers wishing to take advantage of these opportunities can benefit by offering their products on local platforms, where the scarcity of international brands and high prices (which can rise by up to 200%) motivate Latin American consumers to seek better deals and a wider variety internationally.

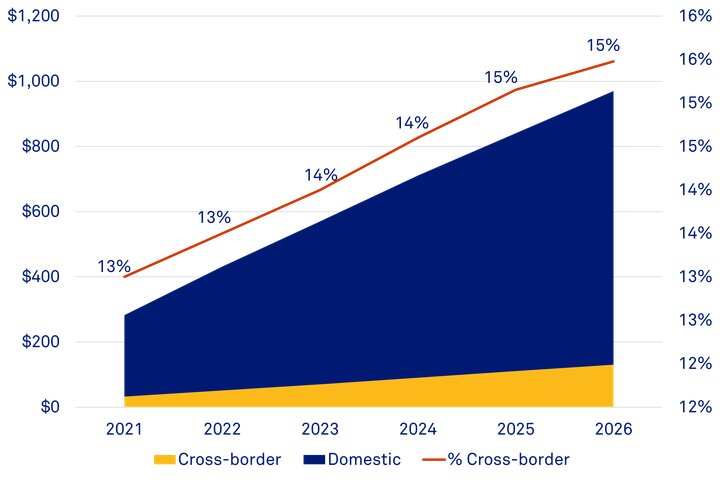

Latin America's e-commerce model for 2023 | Source: PCMI

According to data from Ebanx, international e-commerce sales are growing at a faster rate than domestic ones—45% and 36% respectively.

Marketplaces set the trend in Latin America

Markets such as Magazine Luiza (also known as Magalu) in Brazil and Coppel in Mexico have embraced cross-border e-commerce—the former forming a partnership with Chinese giant AliExpress, and others like Americanas in Brazil resuming it in 2023.

With 78% of total e-commerce sales in the region coming from marketplaces, these channels play a crucial role in the development of e-commerce in Latin America.

Additionally, the fastest growth in cross-border trade is taking place in smaller markets like the Dominican Republic, Ecuador, and Guatemala, highlighting the opportunities for international merchants in these countries.

Meanwhile, in larger and more mature markets such as Colombia, Chile, and Mexico, cross-border e-commerce is growing much faster than domestic online sales, underlining the importance of a strong multichannel strategy to capitalise on these opportunities in 2024.

The challenges of e-commerce in Latin America

To succeed in the Latin American market, it is essential to understand the preferences and culture of local consumers. This involves immersing oneself in the needs, habits, and preferences of buyers in the region.

Selling products through cross-border trade is not just about shipping them overseas; it’s also about exporting brand value and culture.

A deep understanding of the local market allows sellers to resonate with their target audience and meet their needs effectively.

It is crucial not to treat the entire region as a single market, as consumer preferences can vary significantly from one country to another.

Moreover, expanding into international markets within Latin America requires navigating diverse legal frameworks, cultural differences, and language barriers.

Knowing the specific regulations of each country, import requirements, customs procedures, and local consumer preferences is vital for successfully entering new markets.

Fluctuations in exchange rates, political stability, and economic conditions can also impact cross-border trade and add further complexity.

Building trust in online shopping amid fraud concerns

One of the main current challenges in e-commerce in Latin America is the lack of trust in online payments, a concern arising from the high incidence of credit card fraud and identity theft.

Although the landscape has improved thanks to advances in technological and regulatory infrastructure, security remains a barrier. Consumers may hesitate to make online transactions due to fears of fraud, data breaches, or untrustworthy sellers.

To overcome these concerns, it is essential to implement robust cybersecurity measures, transparent policies, secure payment gateways, and effective customer support.

Additionally, educating consumers about the benefits of online shopping and providing positive user experiences can help overcome trust and security barriers.

Payment options tailored to a diverse and underbanked market

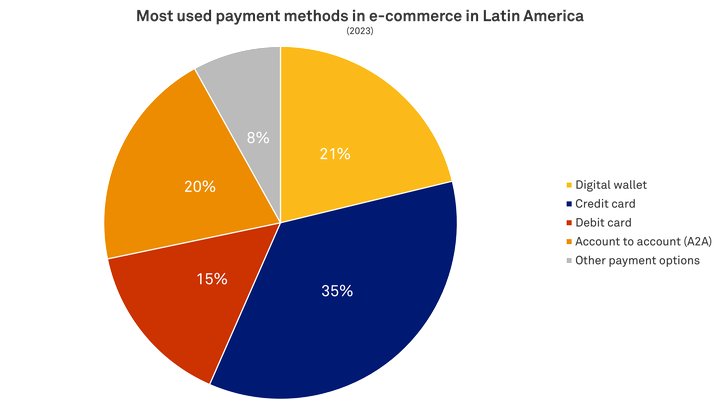

Most used payment methods in e-commerce | Source: Statista

A persistent challenge in Latin America is the significant portion of the population that remains unbanked or underbanked, which poses a barrier for online merchants.

Limited access to traditional banking services, credit cards, and digital payment methods can hinder adoption and slow e-commerce growth.

To address this challenge, businesses must offer alternative payment options such as cash on delivery, mobile wallets, or partnerships with local payment gateways, to meet the needs of the unbanked population and build trust in digital transactions.

These alternatives not only facilitate online purchases but also help include more consumers in the digital economy, thus driving e-commerce growth in the region.

Overcoming geographical barriers for last-mile delivery

In the early years of e-commerce in the region, logistical limitations were a major challenge to market growth in Latin America. Transport infrastructure was less developed, and the lack of efficient delivery solutions hindered the expansion of e-commerce operations.

Although the region has seen significant development in its supply chains, efficient logistics and last-mile delivery continue to pose significant challenges for Latin American e-commerce.

The vast geographical size of the region, combined with complex transport networks and variable infrastructure, can result in delays, high costs, and difficulties reaching remote or rural areas.

Furthermore, customs clearance processes, border restrictions, and regulatory complexities can further complicate the flow of goods.

Overcoming these logistical challenges requires strategic partnerships, investments in distribution networks, and the implementation of innovative delivery solutions.

Efficient management of post-sale issues—such as order problems, lost or damaged parcels, and delivery delays—is also crucial.

When these issues are handled effectively and quickly, customer satisfaction improves significantly. However, if mismanaged, they can negatively impact store performance.

Consolidating e-commerce success in Latin America

As Latin America continues to evolve as a key e-commerce market, the opportunities for international retailers and brands are immense.

However, success in this region depends not only on capitalising on growth, but also on preparing for the unique challenges the market presents.

Understanding local dynamics, investing in infrastructure and logistics, and building trust with consumers are fundamental to fully unlocking the potential of e-commerce in Latin America.

With a strategy well-adapted to local needs and preferences, businesses are ideally positioned to lead growth in one of the most promising e-commerce markets in the world.